Weekly Market Commentary – 3/3/2023

-Darren Leavitt, CFA

US equity markets bounced on oversold conditions and their ability to hold key technical levels this week. The S&P 500 broke its 50-day moving average (3980) and then tested the 200-day moving average (3940) twice but ended the week well above the 50-day. However, the US Treasury market continued to sell off, pushing yields on the front end of the curve higher. This week, the 10-year yield eclipsed 4% and traded as high as 4.07%. Stronger-than-expected price data within a couple of economic data series promoted the move in yields alongside hawkish tones from Federal Reserve officials. In Minneapolis, Fed President Kashkari suggested he would move his policy rate projections higher. At the same time, Atlanta Fed President Bostic expects the Fed to take rates to 5%-2.25% and hold them there until 2024.

The S&P 500 gained 1.9%, the Dow rose 1.7%, the NASDAQ added 2.6%, and the Russell 2000 increased by 2%. The US Treasury curve inverted more this week, with the 2-year note yield increasing eight basis points to 4.86% and the 10-year yield increasing by one basis point to 3.96%. The dollar index shed 0.7%, closing at 104.5. Oil prices rose 4.6% to $79.79 a barrel partly on strong economic data out of China and on reports that the UAE may leave OPEC. Gold prices increased by 2% or $37.20, closing at $1854.20 an Oz. Copper closed at $4.06, an Lb up $.10.

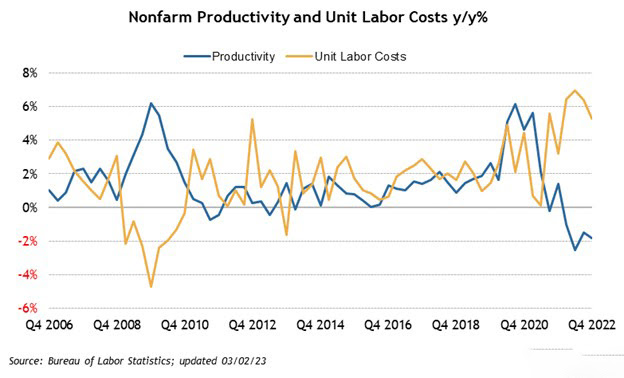

ISM Manufacturing came in a little less than expected at 47, but the prices paid component showed the first uptick in over four months. The print came in at 51.3, and the street had been looking for it to come in at 44.5%. ISM Services also pulled back slightly on the headline at 55.1 versus the consensus estimate of 55.5. Unit Labor Costs in the Productivity report showed an increase of 3.2%, adding to the narrative that wages are not cooling. Initial Jobless Claims showed a resilient labor market, with claims coming in again under 200. Continuing Claims also fell to 1655k from 1660k.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.